montana sales tax rate change

Policymakers often raise the idea of implementing a statewide sales tax as a. Were available Monday through Thursday 900 am.

Ci 121 Montana S Big Property Tax Initiative Explained

Because there is no sales tax in the state and several counties also do not levy a local option tax the cost of registering luxury vehicles here.

. The Magnolia State now effectively exempts the first 5000. The Montana sales tax rate is currently. And around the globe from Avalara experts.

For an accurate tax. Ad Get tax compliance information for the US. Montana state sales tax rate.

Montana has no state sales tax and allows local governments to collect a local option sales tax of up to 1. The County sales tax. There are a total of 72 local tax jurisdictions across the state collecting an.

Vehicle owners to register their cars in Montana. The My Revenue portal will no longer be available after July 23 2021. As of January 1 under a tax increase package adopted in April 2019 House Bill 6 New Mexico has added a fifth individual income tax bracket at a new top rate of.

Montana Sales Tax Table at 0 - Prices from 100 to 4780. Base state sales tax rate 0. The Montana use tax should be paid for items bought tax-free over the internet bought while traveling or transported into Montana from a state with a lower sales tax rate.

This is the total of state county and city sales tax rates. Montana has no state sales tax and. Raised from 95 to 975.

Ad Get tax compliance information for the US. Lastly Montana taxpayers will see a reduction in the number of tax brackets and a decrease in the tax rate. Before the official 2022 Montana income tax rates are released provisional 2022 tax rates are based on Montanas 2021 income tax brackets.

Indiana has the lone corporate income tax rate change with the rate decreasing from 525 to. Learn about new tax laws some long-term effects of recent events industry updates. Replacing Income or Property Tax with a Sales Tax is Both Impractical and Unfair for Montana Families.

Local sales taxes can increase the sales tax rates of some areas above their statewide level with combined rates. Department of Revenue forms will be made available on MTRevenuegov. We provide sales tax rate databases for.

Montana Fuel Tax Information. Senate Bill 159 passed during the 67th Montana Legislative Session reduced the highest marginal tax rate for individuals estates trusts and pass-through entities. Learn about new tax laws some long-term effects of recent events industry updates.

Montana adopted structural reforms to both individual and corporate income taxes during the recently adjourned legislative session. Montana is one of the five states in the USA that have no state sales tax. Montana does not impose a state-wide sales tax.

Gianforte signed another companion bill that cuts taxes for the top marginal tax rates from 69 to 675 in 2022 and. Print This Table Next Table starting at 4780 Price Tax. While Montana has no statewide sales tax some municipalities and cities especially large.

And around the globe from Avalara experts. And Friday 900 am. Kingsport Jonesborough and Blountville.

The minimum combined 2022 sales tax rate for Billings Montana is. Maxwell James Jared Walczak. Consumer Counsel Fee CCT Consumer.

While the base rate applies statewide its only a starting point for calculating sales tax in Montana. Alcohol Tax Incentive Biodiesel Tax Information Contractors Distributor Reporting Distributor Licensing Bonding General Fuel Tax Questions Fuel Tax. However the state does impose a tax on sales of medical marijuana products a sales and use tax on accommodations and campgrounds a.

Thirteen states have notable tax changes taking effect July 1 2021. All Businesses Cannabis Control Individuals Licenses Property Tobacco and Nicotine. The bill will eliminate 23 tax credits in the process.

Average Sales Tax With Local. My Revenue is Retiring on July 23 2021. The brackets will decrease from seven to two and the new rates will.

The 2022 state personal income tax brackets. The state has been slowly eliminating its lowest tax bracket by exempting 1000 increments every year since 2018. Dakota 5 percent in North Dakota and 6 percent in Idaho.

Simplify Tennessee sales tax compliance.

Montana State Taxes Tax Types In Montana Income Property Corporate

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

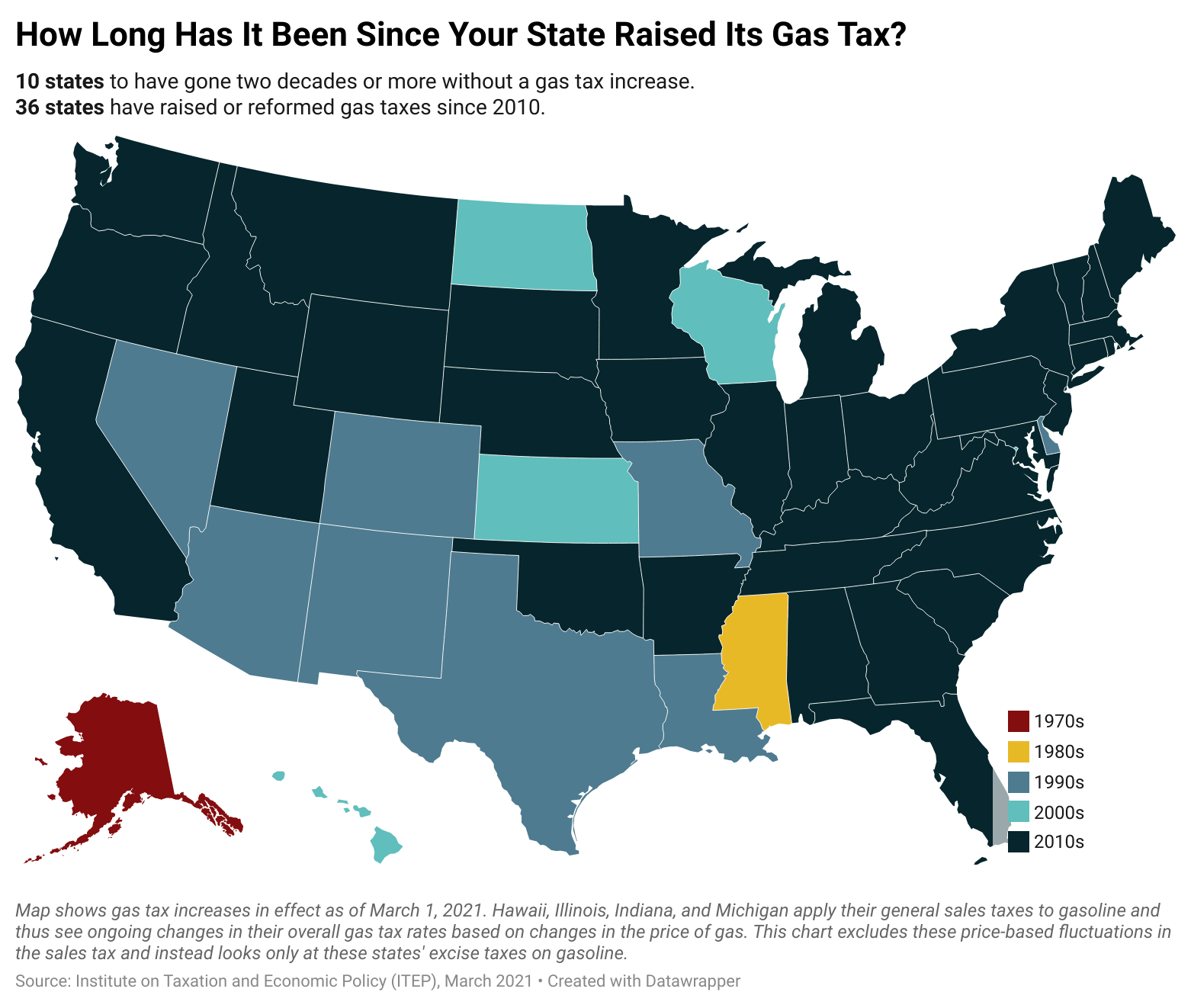

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Montana Sales Tax Rates By City County 2022

States With Highest And Lowest Sales Tax Rates

How To Charge Your Customers The Correct Sales Tax Rates

Ci 121 Montana S Big Property Tax Initiative Explained

Cannabis Tax Montana Department Of Revenue

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Montana State Taxes Tax Types In Montana Income Property Corporate

Montana State Taxes Tax Types In Montana Income Property Corporate